open-end credit meaning and example

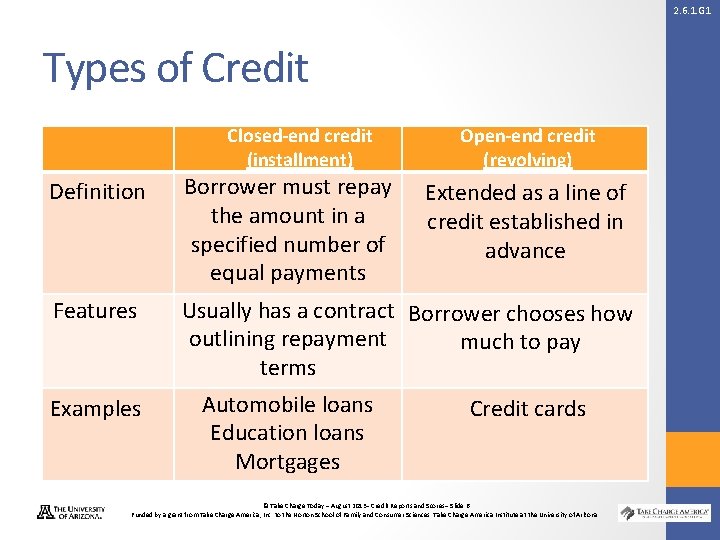

Open-end credit is a preapproved loan between a financial institutionand borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. What is Open-End Credit.

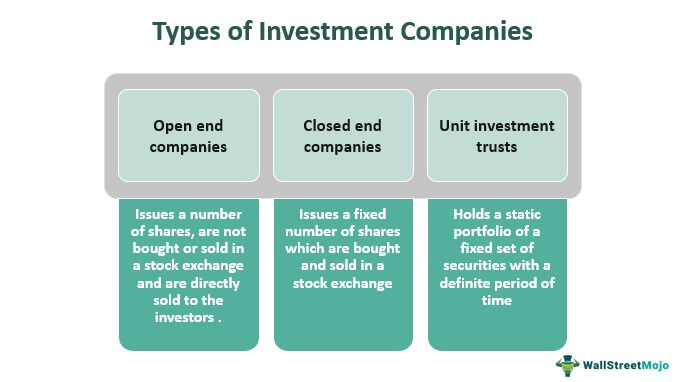

Choosing Closed End Credit Funds Over Equity Funds Seeking Alpha

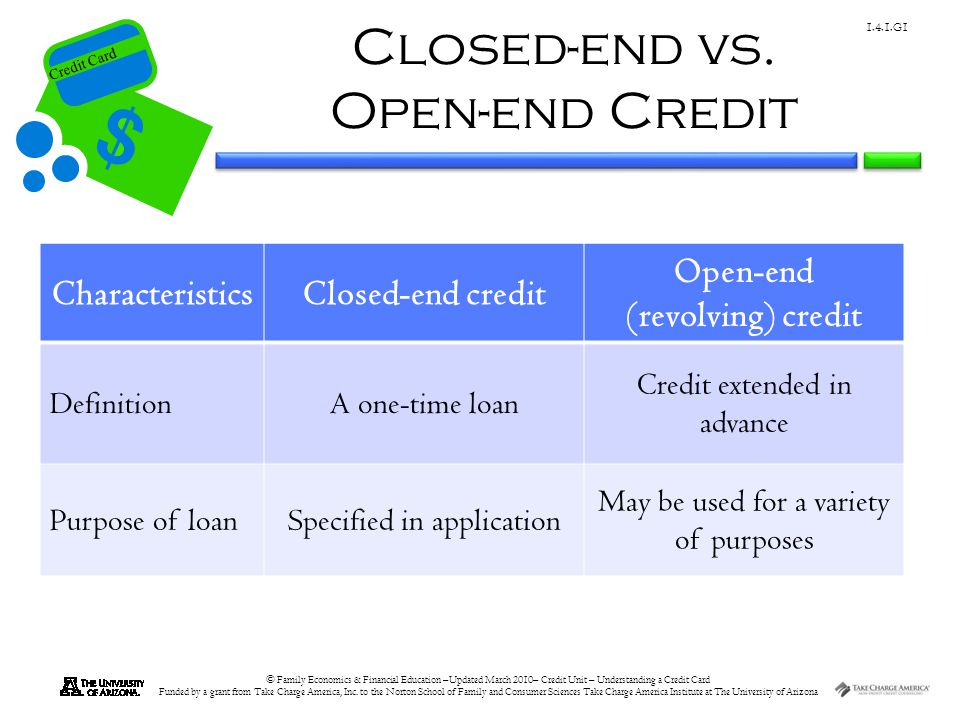

Common examples of open-end credit are credit cards and lines of credit.

. Learn the definition of open end credit. An unsecured open-end loan is a credit line that is not secured by collateral. An arrangement for borrowing from a bank where money.

Credit cards and home equity lines of credit HELOCs on the other hand are open-end or revolving credits. Definition meaning example and more. The most common example of this is a credit card.

Noun C or U BANKING FINANCE uk us. Definition and Example of an Open-Ended Account. The loan has a term of 30 years with a.

Here the borrower can. An agreement between a bank and a company or an individual to provide a certain amount in loans on demand from the borrower. An open ended credit is something like a pre-approved loan where you can use the credit repeatedly over time.

Advisory activity not constituting loan originator activity would include for example licensed accountants. An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed limit and interest is charged. Everything you need to know about Open-End Credit.

An open-ended loan example is your credit card. Example of an Open-End Mortgage. Revolving credit is sometimes referred to as open-end credit.

Credit cards and other revolving accounts are unsecured. In this article youll learn the answers to all of these questions. Open-ended accounts have pre-approved credit limits that allow you to carry an outstanding revolving balance at any.

Open-end credit also i See more. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can. The borrower is under no obligation to actually take.

Open-end credit meaning and example Friday February 18 2022 Edit. The preapproved amount will be set out in the agreement between the lender and the borrower. An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed limit and interest is charged.

An example of this form of loan is an unsecured credit card. For example assume a borrower obtains a 200000 open-end mortgage to purchase a home. The approval of the line of credit is.

An open-end loan for example a credit card is a pre-approved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then. Borrowers generally use closed-end credit to fund expensive. Broadly speaking open-end credit is loan agreement between a lender or a financial institution and a borrower which is also pre-approved.

Noun C or U BANKING FINANCE uk us.

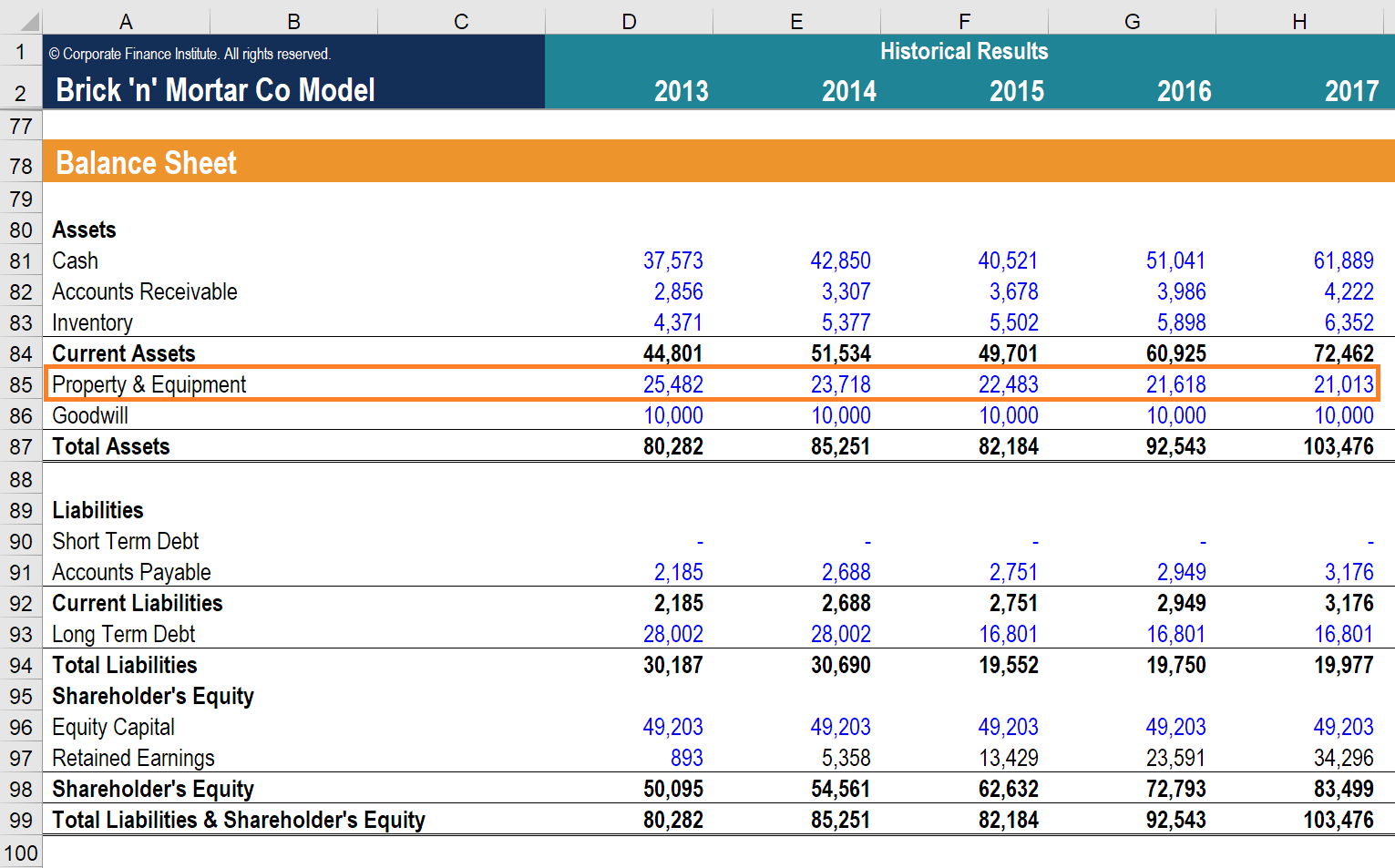

Pp E Property Plant Equipment Overview Formula Examples

Line Of Credit Loc Definition Types And Examples

What Are Interest Rates How Does Interest Work Credit Org

After End Ioa Examples And Means Of Becoming After End Ioa Source Download Scientific Diagram

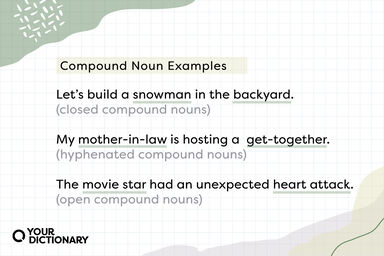

Compound Nouns Definition And Examples

What Is The Difference Between A Lease Finance

What Is Open End Credit Experian

What S The Difference Between Credit Debit Cards Huntington Bank

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

How Many Credit Cards Should I Have 2022 Forbes Advisor

Understanding Your Credit Card Ppt Download

What Is A Niche Market 9 Examples Products To Sell 2022

:max_bytes(150000):strip_icc():gifv()/collaboration-skills-with-examples-2059686-final-47dc0b013a7f45a2b44927f1c01c2cd8.png)

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)